Who Pays Taxes?

October 4, 2005

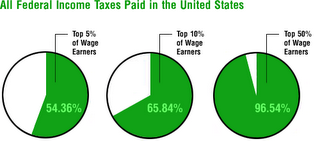

The bottom 50% of income earners pay a grand total of 3.5% of total taxes. IRS Stats

This is the latest data for calendar year 2003 just released in October 2005 by the Internal Revenue Service. The share of total income taxes paid by the top 1% of wage earners rose to 34.27% from 33.71% in 2002.

One problem with this sort of inequality in the tax system is that the majority of citizens no longer have much economic incentive to make tax rates fair or reasonable. The majority of citizens in the United States have now managed to construct a tax system that places little or no obligation on their own shoulders. While paying little, the majority seize from the minority who earn more than average and redistribute this booty as they wish, since they are the majority, and majority rules in a Democracy. The only motivation that restrains the majority is the fear of destroying the goose that laid the golden egg. There is little liklihood of a rebellion by the rich, such as that envisioned by Russian-American novelist and intellectual Ayn Rand in her book Atlas Shrugged.

rushlimbaugh.com

Comments