A Harvard Professor Talks About War and Poker

Link

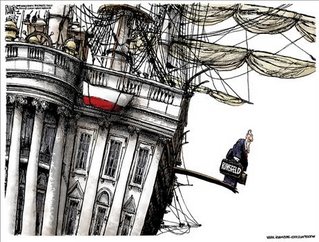

Doubling Down in Iraq

Warfare isn't like business.

by William J. Stuntz

11/20/2006, Volume 012, Issue 10

Don't throw good money after bad. When you're in a hole, stop digging. If you've been running in the wrong direction, the first thing to do is, turn around.

These are the kinds of things Americans are hearing and saying about the war in Iraq. It's understandable: Those familiar sayings are often useful. When you gamble and lose, the natural tendency is to double your bet--and when that doesn't work, mortgage everything you have to try to retrieve your losses. But as every undergraduate economics student knows, that strategy is a disaster. Hence the principle of "sunk cost." The fact that I've lost a pile on some enterprise or investment is no reason to lose an even bigger pile. The smart move, economically speaking, is to reassess your decisions on a regular basis. When an investment isn't working, get out. Put your money, your talents, and your energy to better use somewhere else.

All of which seems to apply to Iraq, in spades. A seemingly quick and easy military victory has turned sour. The costs, in blood and treasure, have escalated. Victory looks uncertain and distant. It seems the time has come, if not to cut and run, then surely to cut our losses. If ever the principle of sunk cost applied to warfare, it would seem to apply here.

But that instinct is wrong. Warfare is not like investment banking. At precisely the moment an economist might say to stop throwing good money after bad, a wise military strategist might say to double the bet.

Why might that be so? For one thing, willingness to raise the stakes often wins the game. Why do insurgent gangs, who have vastly smaller resources and manpower than the American soldiers they fight, continue to try to kill those soldiers? The answer is, because they believe they only have to kill a few more, and the soldiers will leave. They need not inflict a military defeat (which would be impossible, given the strength of the American military)--all they need to do is survive until American voters decide to throw in the towel, which might happen at any moment.

The proper response to that calculation is to make emphatically clear that the fight will not end until one side or the other wins, decisively. That kind of battle can only have one ending, as Abraham Lincoln understood. In a speech delivered a month after his reelection, Lincoln carefully surveyed the North's resources and manpower and concluded that the nation's wealth was "unexhausted and, as we believe, inexhaustible." Southern soldiers be gan to desert in droves. Through the long, bloody summer and fall of 1864, the South had hung on only because of the belief that the North might tire of the conflict. But Lincoln did not tire. Instead, he doubled the bet--and won the war.

There is another reason economic logic does not readily apply to the fighting of wars. When running a business, one aims to invest just as much as is necessary to make the sale or manufacture the product--no less, and no more. Profit equals revenue minus cost, so minimizing cost lies at the core of wise business management.

Warfare could not be more different. Send just enough soldiers and guns and tanks to do the job, and you may soon find you have sent too few. The enemy concludes that if it can raise the marginal cost of the conflict just a bit, if casualties are a little higher or the expense a tad greater than you imagined, you'll quit the field. On the other hand, send vastly more soldiers and materiel than required to the battlefield, and the enemy soon decides that the fight is hopeless--that, as Lincoln so elegantly put it, our resources are unexhausted and, as we believe, inexhaustible.

In the world of business, decisions are made at the margin: a little more invested here, a bit less there; everywhere, strive to cut waste, to spend no more than is absolutely necessary. In warfare, waste and excess are productive: They send the message that victory is inevitable, that whatever resources are needed to obtain it will be given to the task. That is the essence of what military historian Russell Weigley called "the American way of war." Overwhelm the enemy--instead of investing just enough, invest far too much. Make sure the other side knows that our capacity to give and take punishment immeasurably exceeds their capacity to absorb and inflict it.

The difficulties the Army has experienced in Iraq are due, in large measure, to the fact that the Defense Department forgot this historical lesson. Donald Rumsfeld tried to run a businesslike war. But warfare is not business; it is not fought at the margin. By striving to do just enough to win, we have done too little. The right strategy is to do too much.

That is especially true of a war like the one in Iraq. Consider these data: Between November 2004 and February 2005, according to the Brookings Institution's Iraq Index, the number of coalition soldiers in Iraq rose by 18,000. In that time, the number of Iraqi civilians killed fell by two-thirds, and the number of American troops wounded fell by three-fourths. The soldiers were soon pulled out; by the summer of 2005, American and Iraqi casualties rose again. Later that year, the same thing happened again. Between September and November of 2005, another 23,000 soldiers were deployed in Iraq; once again, both Iraqi and American casualties fell. In the early months of 2006, the number of soldiers fell again, and casualties spiraled up.

The picture is clear: More soldiers mean less violence, hence fewer casualties. The larger the manpower investment in the war, the smaller the war's cost, to Iraqis and Americans alike. Iraq is not an unwinnable war: Rather, as the data just cited show, it is a war we have chosen not to win. And the difference between success and failure is not 300,000 more soldiers, as some would have it. One-tenth that number would make a large difference, and has done so in the past. One-sixth would likely prove decisive.

Counterinsurgency warfare is more about protecting than killing--like a nationwide exercise in community policing. And the lesson of the 1990s in American cities is that the best way to reduce the level of criminal violence is to put more cops on the street. The lesson of the past three years in Iraq is the same: If the goal is to cut our losses, the best move is not to pull back, but to dive in--flood the zone, put as many boots as possible on the most violent ground. Do that, and before long, the ground in question will be a good deal less violent.

War is not poker; the stakes in Iraq are much higher than a little money or a few chips. But war's psychology bears some resemblance to a well-played game of cards. The only way Americans lose this war is to fold. That seems likely to be the next move, but it is the last thing we should do. Far better to call and raise. Our cards are better than theirs, if only we have the nerve to play them.

William J. Stuntz is the Henry J. Friendly professor at Harvard Law School.

Comments